Are the BFIs earning profit by putting the Customers at Risk ? Checkout the Compliance of Spread Rate

It was few years back when BFIs were directed to put a cap on the spread rate of interest. Since then, BFIs are not allowed to have this rate more than 5%. Spread rate is nothing but the gap between the interests charged from borrowers and those given to depositors. Spread is the primary source of Income for BFIs.

The NRB had fixed the spread rate after realizing that depositors were given less return on the fund parked in Banks, whereas the borrowers were charged with high interest. After the introduction of spread rate, banks that provide interest of, let’s say, 5% to depositors cannot charge more than 9% from borrowers.

Spread rate was actually supposed to work as a ceiling. That means, should have lowered due to competition, in order to attract both depositors and borrowers. However, this doesn’t seem to be working in the current scenario. Some BFIs are having a spread rate of more than specified, in order to earn higher net profit. Though BFIs are bound to increase their earning in order to meet the pace of capital increment, they should not do this at an expense of their customer (borrowers and lenders). As it is ultimately the customer to whom they server and earn.

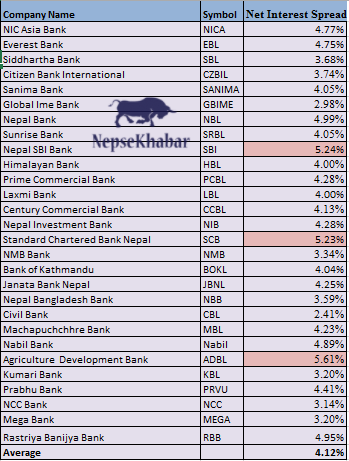

Team NepseKhabar, has tried to compile the data of the 28 commercial banks, so as to understand the present situation of spread.

On analyzing the commercial banks in terms of Net Spread, the average stood below the point specified by the governing bank. Majority of the banks had respected the rule, however 3 of the high profit earning banks were not seen complying the directive. Where Standard Chartered Bank had a Net Spread of 5.23%, the state owned Agriculture development bank had a spread of 5.61%. Similarly, Nepal SBI Bank had a spread rate of 5.24%. These banks, often referred as blue chip companies, though might have satisfied the shareholders but have failed to do the same for customers and law makers. Disrespecting the laws, especially by such renowned banks, not only hampers their goodwill but also might encourage other fellow institutions to the same.

In the meanwhile, one of the youngest commercial bank, Civil Bank have operated at the least spread of 2.41%. Similarly, Global IME had a Net Spread of 2.98%