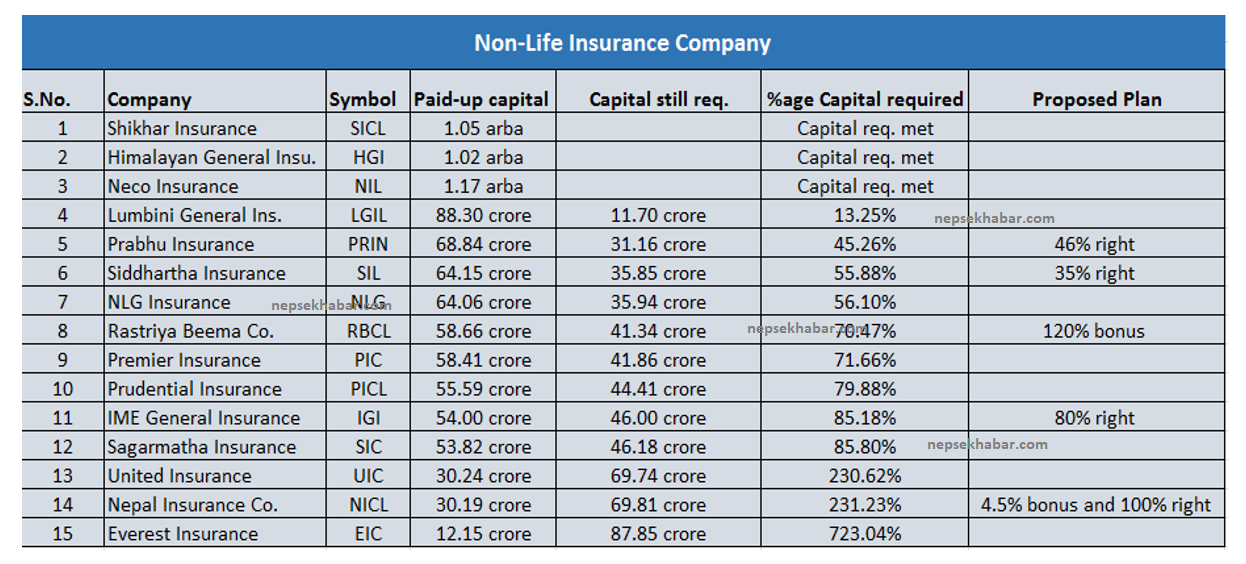

Checkout the Current Paid-up Capital of Non-Life Insurance Companies; also know how much they further need to increase

As per the Insurance Board directives, Insurance Companies need to increase their paid-up Capital by the end of FY 2074/75. Where Life insurance companies need to hike their capital to Rs 2 arba, non-life insurance companies need to reach 1 arba. Companies have several options for the capital increment which includes issue of bonus shares, right shares or even go for a public issue again i.e. FPO.

This article tries to present the current capital and further capital requirement of non-life insurance companies. There are a total of 15 non-life insurance companies currently operating in Nepal. Out of those 15, three have successfully met the capital requirement and have a paid-up capital more than 1 arba.

Note:

- FPO and bonus share has been adjusted for PIC

- Bonus share has been adjusted for NLG ,PRIN, LGIL

- 50% right issue has been adjusted for Neco Insurance

Out of the 15 non-life insurance companies, companies such as Shikhar Insurance, Himalayan General and Neco Insurance have successfully met their paid-up capital requirement before the deadline whereas Lumbini General Insurance needs to hike its capital by merely 13.25% to reach 1 arba. Companies like Prabhu Insurance, Siddhartha Insurance and IME General Insurance have planned to issue right share that will help them reach near their target capital.

However, companies like United Insurance, Everest Insurance, Nepal Insurance Company still need to increase its capital by huge percentage within a short period of time.