Profit Growth of Commercial bank slows down as Interest expense Increases

Lately, if we open a newspaper or an online news portal, we can easily see BFIs advertising their increased interest rates. We are all aware of the controversy NIC ASIA is facing with the increased interest rate. The increase benefits the depositors whereas become troublesome for borrowers. But does this affect shareholders? Is it just the depositors and borrowers who are concerned or it also affects the shareholders?

Well, the answer is, Shareholders are directly affected by the change in interest rate.

The upward trend of offering lucrative interest rate on deposit started last year when BFIs started touching the ceiling for CCD. Thus, in order to extend further loan they needed additional deposits, which invited an unhealthy competition for interest rates.

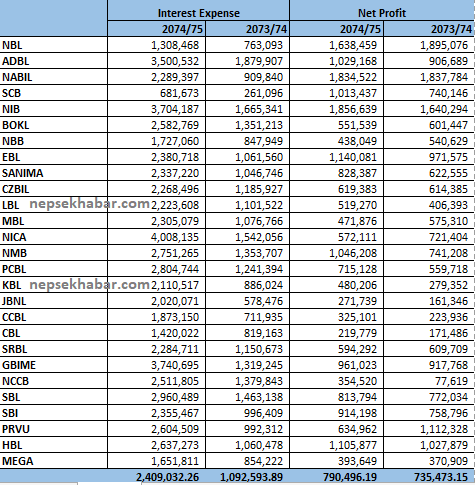

The above data represents the Interest expense and Net profit for the year 2074/75 and 2073/74.

The rising interest rates has shown an adverse effect on Commercial bank’s net profit growth. As per 2nd quarter report of 2074/75, Net profit growth of Commercial bank was limited to merely 7.48%. This data was as high as 36.44% last year. Where the avg. Net profit of 27 commercial banks surged from Rs 54.89 crores to 73.5 crores last year, an increment of only 5.50 crores was noticed in this year.

On analyzing the reason behind the slow growth rate, the prime reason was found to be the rise in interest expense. The avg. interest expense of commercial banks surged by massive 120% in last one year. Where the avg. interest expense was Rs 1.09 arba last year, it escalated to 2.40 arba this year. This rise has directly affected commercial banks net profit.

Where, the increased supply of shares has decreased market price of shares, the rising interest expenses can decrease company's profit thus disappointing the investors. Thus, the BFIs should plan well before rising the interest rates, such that no stakeholders suffers either it be borrowers or the shareholders.