Ipo Analysis : Aarambha Microfinance Bittiya Sanstha

Company Overview

Having the registered office at Kavrepalanchok-10, Aarambha Microfinance is a 15 district microfinance company. Commencing its operation on 2072/04/07, Aarambha is currently operating from 16 branches. This microfinance company was established with an aim to invest and thus uplift the standard of women and marginalized group. Though the devastating earthquake became an obstacle in the initial days, the company later expanded its services. Aarambha is currently providing microfinance service to its 9,165 members.

Issue Details

|

Company Name |

Aarambha Microfinance Bittiya Sanstha Ltd. |

|

Total Issue Units |

2,94,000 |

|

Units for General Public |

2,70,480 |

|

Minimum Units to be Applied |

50 |

|

Maximum Units to be Applied |

1,000 |

|

Issue Open |

2074/11/15 |

|

Issue Close (On Early) |

2074/11/21 |

|

Issue Close (Late) |

2074/11/29 |

|

Units for Mutual Funds (5%) |

14,700 |

|

Units For Employees (3%) |

8,820 |

|

Issue Manager |

NIC ASIA Capital Limited |

Capital Structure

|

Particulars |

Amount |

|

Authorized Capital |

Rs 12 crores |

|

Issued Capital |

Rs 6 crores |

CEO Profile

Mr. Binod Acharya is the Chief Executive Officer of the company and has an experience of more than 20 years in Microfinance sector. Having a good academic qualification, Mr. Acharya holds Masters Degree in Public Administration (MPA) from Kathmandu and a Masters Degree in Business Administration (MBA) from London, UK. He has also worked as a General Manager in Deprosc Nepal (FINGO- microfinance Institution).

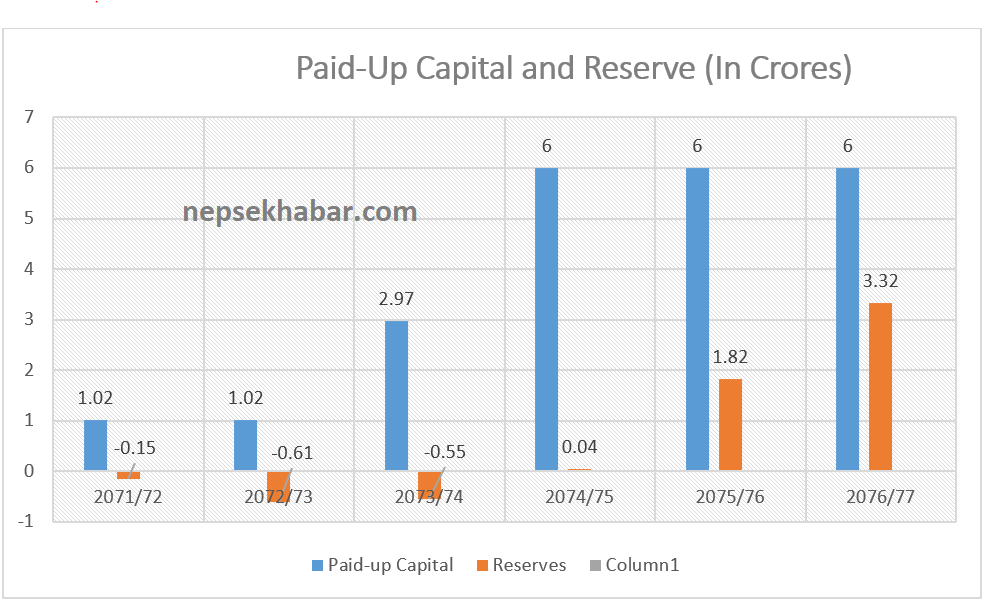

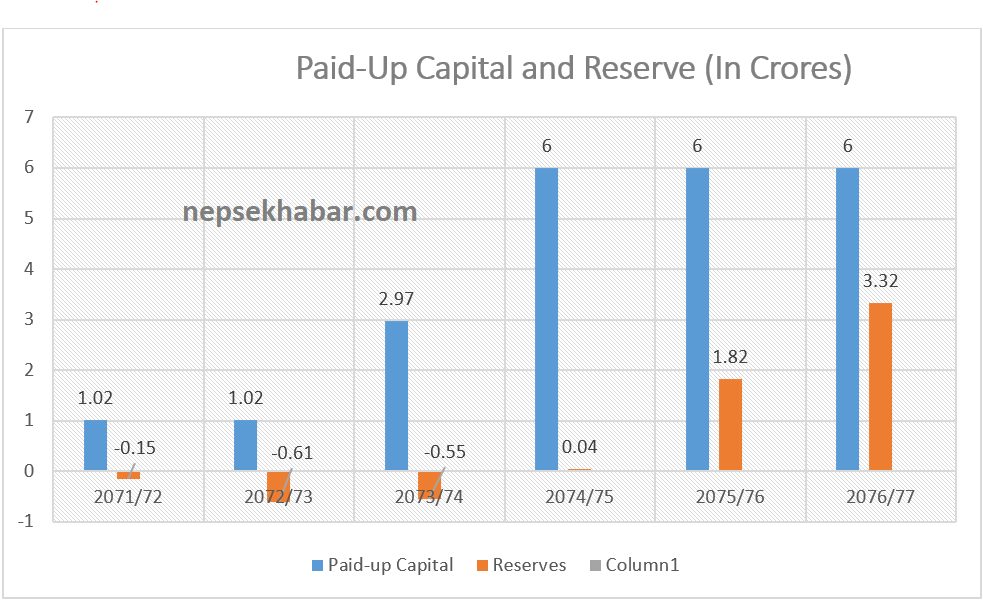

Paid-up Capital

The Company started its operation with a capital of Rs 1.02 crores back then in 2071/72. The company had a negative reserve of Rs 15 lakh at that time. However, during this three years of operation the reserve reported a loss Rs 55 lakhs. Aarambha microfinance had a capital of Rs 2.04 crores as of 2073/74. 50% right issue to promoters along with the IPO will raise the company’s capital to Rs 6 crores. The company is expecting to increase its reserve to Rs 3.32 crores by the end of FY 2076/77. Company’s capital of RS 2.97 crores includes 93.80 lakhs received as a call in advance for 2:1 right shares.

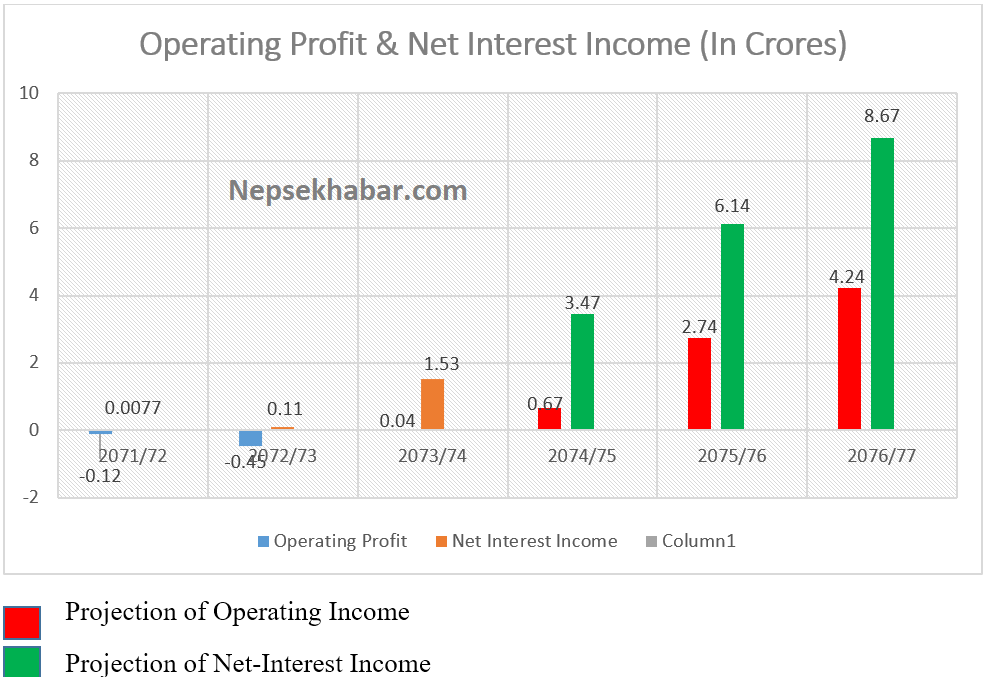

Operating Profit and Net Interest Income

Net-Interest Income is considered to be a primary source of income for any BFI and contributes a major portion of Operating Income. Increasing trend of both operating profit and net interest income is considered as a good sign for a company. Aarambha Microfinance had an operating profit of Rs 4.18 lakh and a net interest income of Rs 1.53 crores last year. The company was at an operational loss of Rs 12.90 lakh at the year of inception.

The company projects to raise its Operating profit to Rs 4.24 crores by the year 2076/77.

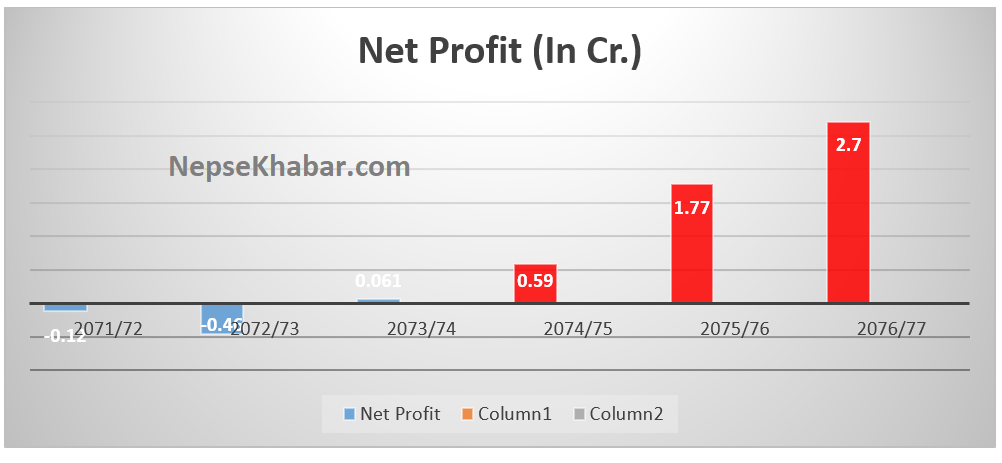

Net Profit

Net profit is the income after deducting every kind of operating and non-operating expenses. Higher the Net profit, the better it is. The success of a company is generally measured in terms of net profit. Some portion of this income moves to the reserve whereas some is distributed amongst the shareholders in the form dividend. Thus, this is one among the major parameters that concerns an investor. An investor can expect a dividend based on how much the company has earned.

Aarambha microfinance was at a net-loss of Rs 0.12 crores in the first year of its formal operation. However, The Company successfully increased its earning and reduced its expenses, As a result aarambha earned a net profit of Rs 6.19 lakhs in the year 2073/74. The company further projects to increase its net profit to Rs 2.70 crores by the end of year 2076/77.

Key Indicators

|

Earning Per Share (EPS) |

2.07 |

|

Net-worth Per Share |

81.30 |

|

NPL |

0.00% |

|

Avg. Growth in Net profit |

-113.3% |

|

Avg. Growth in Loans and Advances |

82.5% |

Application Procedure

Interested applicants can apply for the IPO using meroshare or from any BFI and their branches providing c-asba facility.

Analyzing the company’s fundamental performance, it is seen that the company being new to the market doesn’t have a good market share. The company also has negative reserve and a below average earnings. However, the company is progressing and has a room to grow.

From an investor’s perspective, this issue can be attractive as one can expect a good price in the secondary market. The minimum units just being 50, one can invest in the company with just Rs 5000 in hand. Just like IPO of other microfinance companies, we can expect a huge number of applicants in this issue. People looking for short term capital gain as well as long term investors can apply for this share.