IPO Analysis : Nepal Seva Laghubitta

Company Overview

With the registered office in Sindhupalchok, Nepal Seva Laghubitta is extending its services from 8 branches located in 3 different districts, namely: Sindhupalchowk, Nuwakot and Rasuwa. Registered on 2070/08/16 as a public limited company, the company started its commercial operation from 2071/08/08.

|

Company Name |

Nepal Seve Laghubitta Bittiya Sanstha |

|

Total Issue Units |

1,80,000 |

|

Units for General Public |

1,67,400 |

|

Minimum Units to be Applied |

50 |

|

Maximum Units to be Applied |

900 |

|

Issue Open |

2075/01/12 |

|

Issue Close (On Early) |

2075/01/16 |

|

Issue Close (Late) |

2075/02/10 |

|

Units for Mutual Funds (5%) |

9000 |

|

Units For Employees (2%) |

3600 |

|

Issue Manager |

NMB Capital Limited |

Capital Structure

|

Particulars |

Amount |

|

Authorized Capital |

Rs 10 crores |

|

Issued Capital |

Rs 6 crores |

|

Paid-up Capital |

Rs 6 crores (after IPO) |

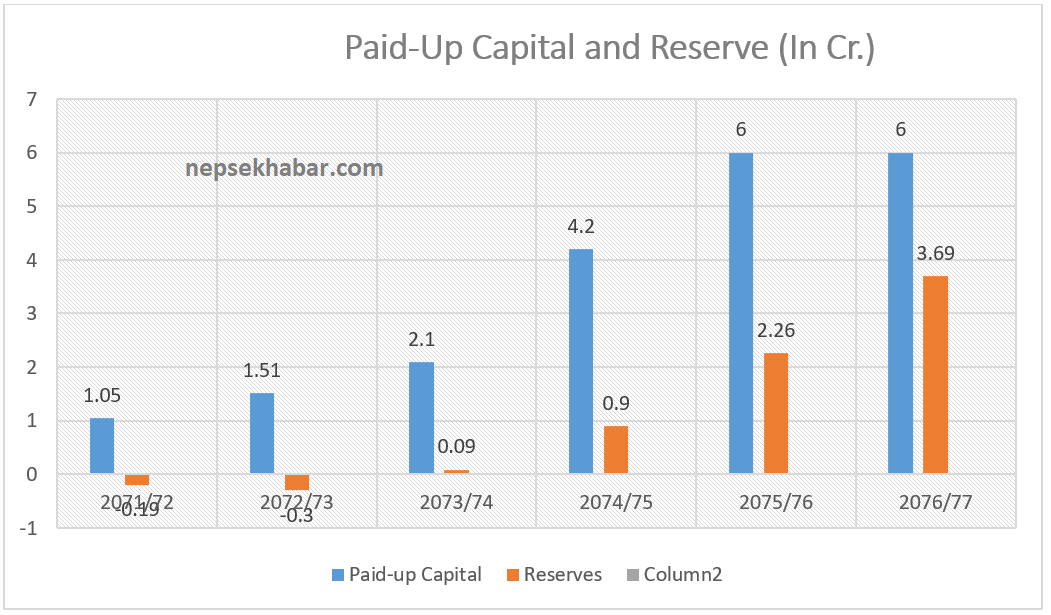

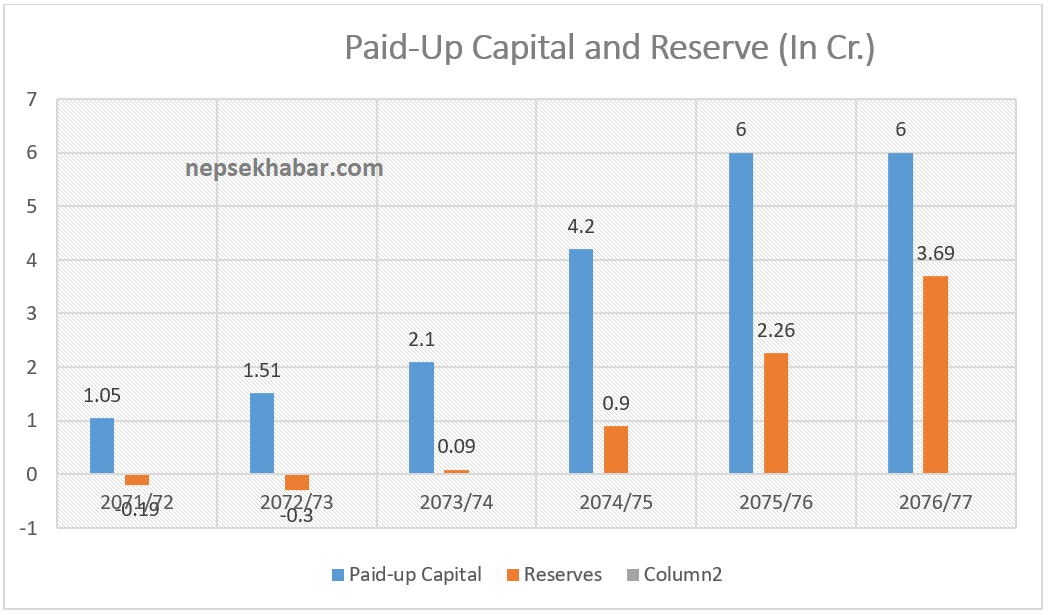

Paid-up Capital

The Company started its operation with a capital of Rs 1.05 crores back then in 2071/72. The company had a negative reserve of Rs 19.01 lakh at that time. However, during this three years of operation the company successfully raised its reserve to Rs 11.08 lakh. The company is expecting to increase its reserve to Rs 3.69 crores by the end of FY 2076/77.

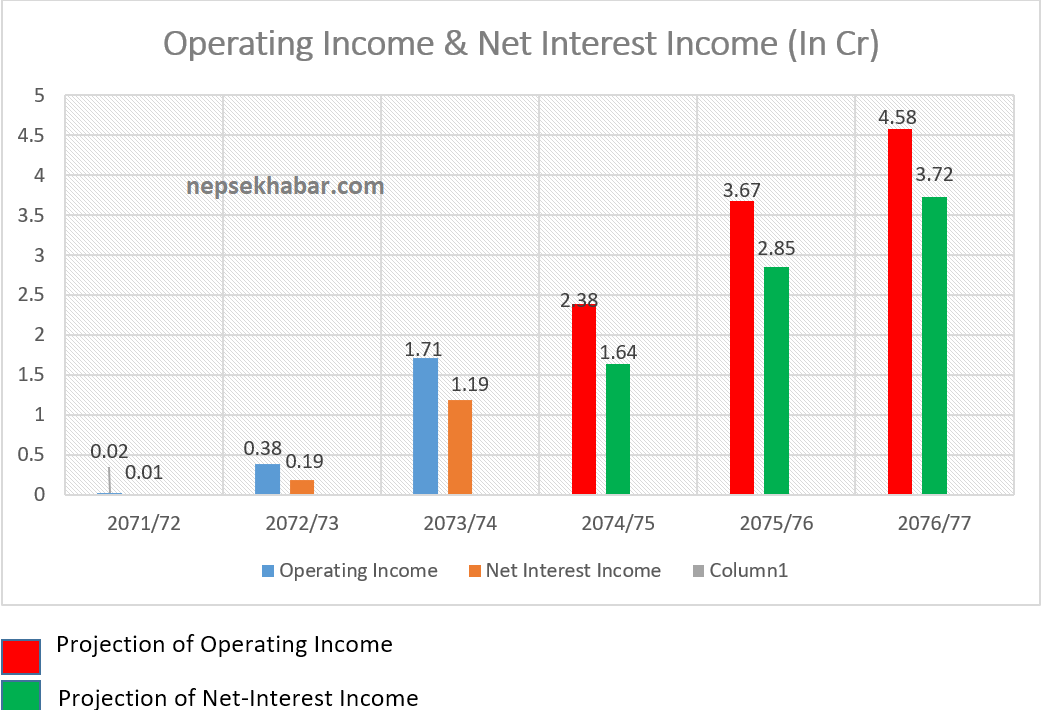

Operational Income and Net Interest Income

Net-Interest Income is considered to be a primary source of income for any BFI and contributes a major portion of Operating Income. Increasing trend of both operating income and net interest income is considered as a good sign for a company. Nepal Seva Laghubitta had an operating income of merely Rs 2.90 lakh and a net interest income of Rs 1.32 lakh on the year of its inception. The company successfully raised its operating income and Net interest income to Rs 1.71 crore and Rs 1.19 crore resp. as of last year.

The company projects to raise its Operating income and Net Interest Income to Rs 4.58 crores and 3.72 crores by the year 2076/77.

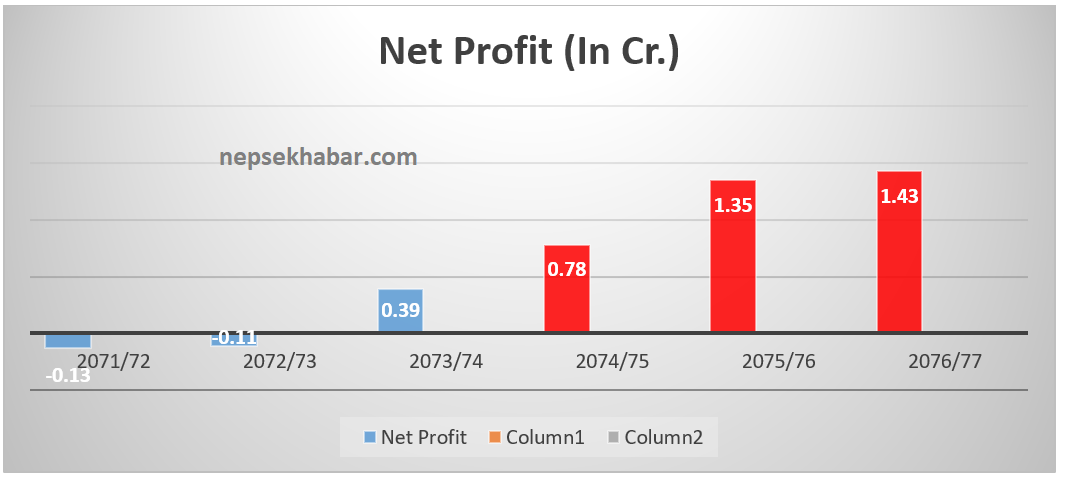

Net Profit

Net profit is the income after deducting every kind of operating and non-operating expenses. Higher the Net profit, the better it is. The success of a company is generally measured in terms of net profit. Some portion of this income moves to the reserve whereas some is distributed amongst the shareholders. Thus, this is one among the major parameters that concerns an investor. An investor can expect a dividend based on how much the company has earned.

Nepal Seva was at a net-loss of Rs 13.89 lakh in the first year of its formal operation. However, the Company successfully increased its earning and reduced its expenses, as a result Nepal seva earned a net profit of Rs 39 lakh in the year 2073/74. The company further projects to increase its net profit to Rs 1.43 crores by the end of year 2076/77.

One can apply for this public issue filling the ASBA form from any ASBA member.

Key Indicators (Expected 2074/75)

|

Particulars |

Amount |

|

Earning per Share |

13.15 |

|

Networth Per Share |

115.01 |

|

NPL |

0.75% |

|

Avg growth in Deposit |

46.41% |

|

Avg growth in loans and advances |

30.06% |

|

Avg growth in Net Profit |

3984.03% |

Takeaway

Analyzing the company’s fundamental performance in the past, the company looks below average. However, due to the high price of microfinance companies in the secondary market and allotment time period being a week at max., we can conclude this issue as lucrative. The minimum units just being 50, one should invest for minimum units as “minimum 10 unit allotment rule” will be applicable.

The issue many not be attractive for the big investors and investors wanting huge dividends every year, as the company doesn’t have a huge earnings as of now. However, analyzing the trend, capital gains received in the secondary market can attract a lot of new and retail investors as the initial investment of “X” can easily turn “10X” within a short time.