Is it worth applying for NMB Bank FPO???

In the due course of expanding the paid-up capital, 21st AGM of NMB Bank had endorsed the agenda of capital increment through FPO. Later the Board meeting of the company held on Poush 24, 2073 decided to issue 1,14,15,163 units shares at a premium price. The issuance of shares through FPO would not only increase the capital and collect reserves but also dilute the promoter shareholding to 51%.

NMB Bank had previously issued FPO to its Joint Venture Partner (FMO Netherland) at Rs 250.

|

Company Name |

NMB Bank |

|

Total Issue Units |

1,14,15,163 |

|

Issue Price (Rs) |

333 |

|

Minimum Units to be Applied |

10 |

|

Maximum Units to be Applied |

57,070 |

|

Issue Open |

2075/02/30 |

|

Issue Close (On Early) |

2075/03/03 |

|

Issue Close (Late) |

2075/03/28 |

|

ICRA Rating |

Grade 3 |

|

Issue Manager |

Citizen Investment Trust |

Key Positions:

- Chairman : Mr. Pawan Kumar Golyan

- Director : Mr. Manoj Kumar Goyal

- Director : Mr. Rajendra Kafle

- Director : Mr. Nico Klaas Gerardus Pijl

- Director : Mr. Hari Chandra Subedi

- Director : Mr. Hari Babu Neupane

- Director : Mr. Pradip Raj Neupane

- Alternative Director : Mr. Nanda Kishor Rathi

- CEO : Mr. Sunil Kc

Dividend History

|

Fiscal Year |

Cash Dividend (%) |

Stock Dividend (%) |

Total (%) |

|

2072/73 |

1 |

19 |

20 |

|

2071/72 |

0.42 |

8 |

8.42 |

|

2070/71 |

1.05 |

20 |

21.05 |

|

2069/70 |

10 |

- |

10 |

|

2068/69 |

- |

- |

- |

As the company has not published an annual report for the fy 2073/74 and the company’s prospectus doesn’t look updated, so the 4th quarter data has been used for 2073/74 below.

Shareholder’s Equity

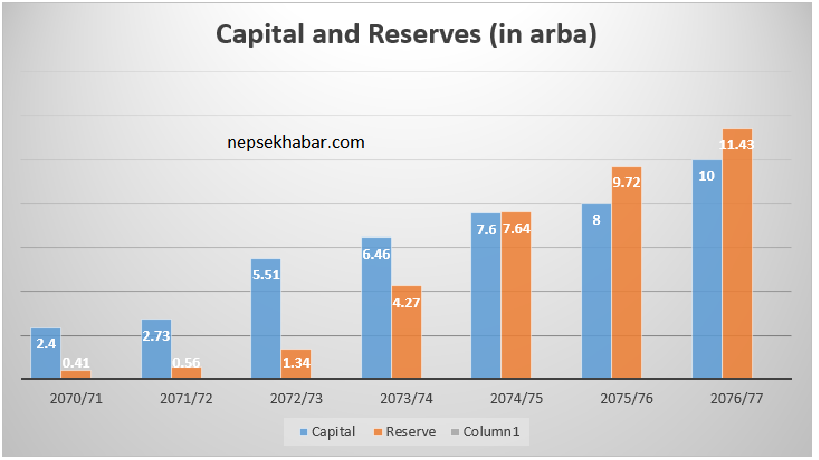

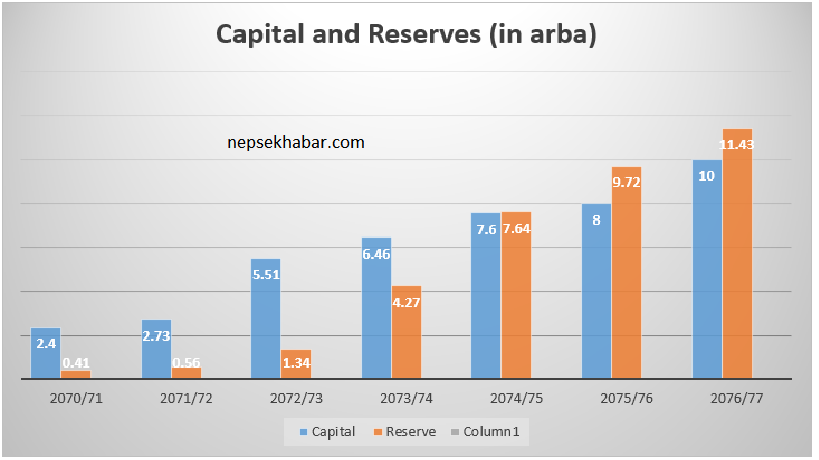

At the present context, NMB Bank is one among the few banks which is yet to meet the required paid-up capital of Rs 8 arba. The issuance of FPO and a single digit bonus distribution after that, will be enough for the company to meet the target paid-up. The best thing about the company, after the FPO, will be the reserve. NMB Bank will have a reserve almost equal to the paid-up capital, making the company fundamentally more strong.

Seeing the company’s projection, the company have no plans to increase capital next year. However, the company wishes to raise the capital to Rs 10 arba thereafter. A bonus share of 25% can be expected in the fy 2076/77. The reserve, at that time, is projected to be Rs 11.43 arba.

The Net-worth per share of the bank will rise to Rs 196 after the public offering. When compared to the industry, NMB Bank will be ranked 4th in terms of net-worth per share. Only Nepal Investment Bank, Nabil Bank and Agriculture Development Bank will have a net-worth more than NMB Bank.

|

S. No. |

Company Name |

Net-worth Per Share (Rs) |

|

1 |

Agriculture Development Bank |

213.41 |

|

2 |

Nabil Bank |

209.62 |

|

3 |

Nepal Investment Bank |

202.57 |

|

4 |

NMB Bank |

196 |

Deposit and Lending

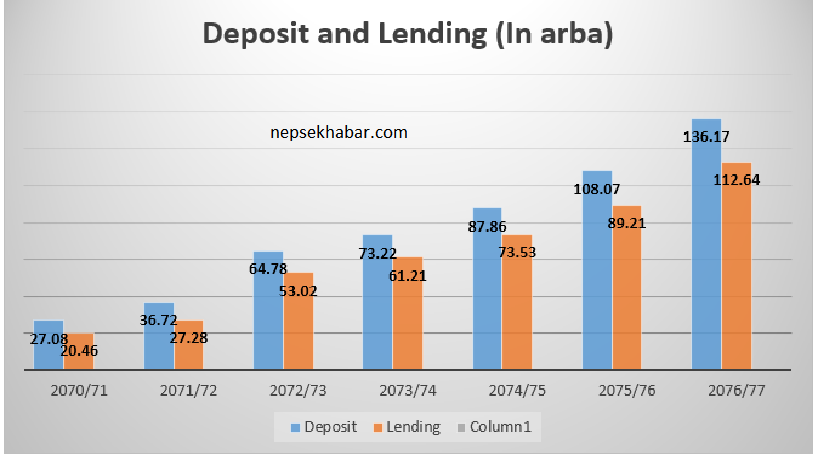

Collecting deposit from people with excess money and lending it to the needy one, is the primary business model of BFIs. A higher interest is charged from borrowers and lower interest is given to the lenders. A spread earned in between is the profit for banks. Thus, in order to have an increasing profit, a bank needs to have an increasing deposit such that it gets enough fund to lend.

On analyzing the deposit and lending of NMB Bank, a fine growth can be noticed. The company further projects a per year deposit growth of over 20% in the next three years. The projection seems reliable as the company has proven it in the past. Similarly in case of lending, the bank projects a growth rate of over 20% each, in the next three years.

As per the 3rd quarter of 2074/75, NMB Bank had collected a deposit of Rs 85.29 arba and lent Rs 74.03 arba. Both the data were more than the industrial average. Nepalese Commercial Bank Industry had collected an average deposit of Rs 78.37 arba and lent Rs 69.58 arba on average.

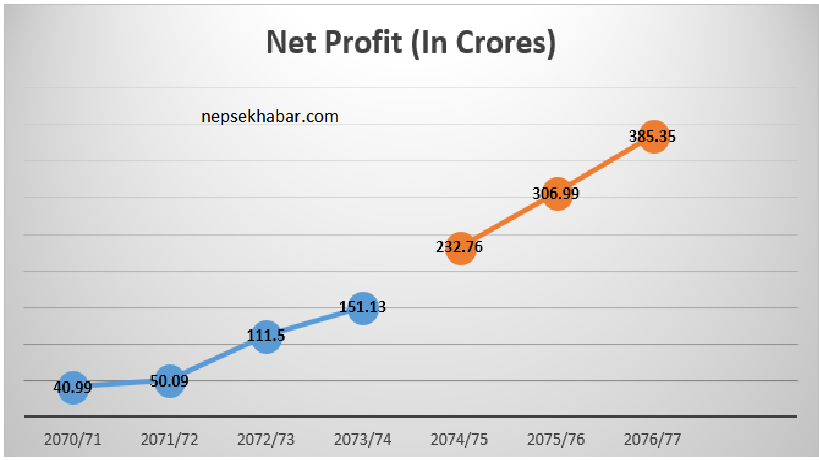

Net Profit

Net profit is the income after deducting every kind of operating and non-operating expenses. Higher the Net profit, the better it is. The success of a company is generally measured in terms of net profit. Some portion of this income moves to the reserve whereas some is distributed amongst the shareholders. Thus, this is one among the major parameters that concerns an investor. An investor can expect a dividend based on how much the company has earned.

Key Ratios based on 3rd quarter 2074/75

|

Earnings Per Share (EPS) |

Rs 29.09 |

|

P/E Ratio (Based on FPO Price) |

11.44 times |

|

P/B Ratio (Based on FPO Price) |

1.78 times |

|

Net worth Per Share |

Rs 187.21 |

|

CCD Ratio |

75.33% |

|

Non- Performing Loan |

1.10% |

|

Capital Adequacy Ratio |

12.93% |

|

Return on Equity (ROE) |

16.95% |

|

Return on Assets (ROA) |

2.00% |

Takeaways

This issue may not be lucrative for retail investors looking quick capital gain. The market price of the company being quite near to the FPO price can put short term investors at risk. The supply units being gigantic, can further contribute in decreasing the market price.

However, the company is fundamentally one of the strongest in the industry. The FPO will further raise a tremendous premium which will significantly increase the company’s reserve. Analyzing the company’s trend, an above average growth is registered every year which can again make the investment worthy. Thus, long term investors, looking to park their funds in a company that can provide above average return and high capital gains, can invest in this FPO. Though the FPO price looks inappropriate when compared with the market price, the price seems reasonable when valued based on the company’s fundamentals and growth prospects.

How Much to Invest?

Though one can apply for a minimum of 10 units and maximum 57,070 units, investors are suggested to apply for 50-100 units. Based on the past application number, a maximum of 2 lakh applicants can be expected which will make investors eligible for above 50 unit shares. Since, less number of retail applicants are expected, one can fully be allotted for units between 50-100.