Is it worth blocking your fund in Premier Insurance FPO ?

With a series of IPOs and FPOs coming in a row, one might get confused regarding which company to invest and which one to skip. In spite of the rule regarding 10 kitta of sure allotment investors have to depend on their luck in order to get the shares. The reason definitely is the imbalance of the demand and supply.

So is it worth locking up your fund for the shares that is to be allotted through lottery?

Well, the answer depends on how profitable the company is, and how high is the probability of being allotted with the shares. To ease the investors in making decision, this article has tried to compile all the essential information regarding the Further Public Offering (FPO) of Premier Insurance Company (PIC).

| Issue type | Further Public Offering |

| Issue Units | 6,59,565 |

| Issue Price (Rs.) | 799 |

| Issue Open | 2074/09/16 |

| Issue Close Date (Early) | 2074/09/19 |

| Issue Close Date (Late) | 2074/10/15 |

| Minimum Units to apply | 10 |

| Maximum Units to apply | 3290 |

| ICRA Rating | [ICRANP] IPO Grade 3+ |

| Issue Manager | NMB Capital Limited |

Company Overview

Providing the insurance service from 38 branches, Premier Insurance Company started its commercial operation from 2051/01/29. With 40% of the total shares among general public, this company has been generating a good profit since its inception. The company was established with an aim of providing quality insurance service to the customers. Along with this, the company has provided employment opportunity for the skilled manpower and has successfully been providing the shareholders with handsome return.

Capital Structure

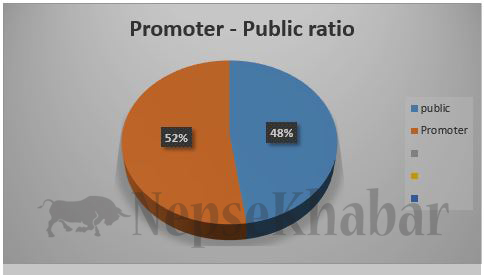

The promoter – public ratio of the company will change to 52.31: 47.69 after the further public offering, with 26.91 lakh units held by promoters and 24.53 lakh units held by public.

| Particulars | Amount (Rs.) |

| Authorized Capital | 2 Arba |

| Issued Capital | 1.50 Arba |

| Paid-up Capital | 51.44 crore ( After FPO) |

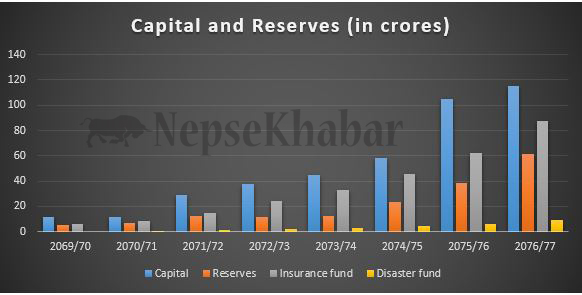

Company’s Paid-up Capital and Reserve

| Year | Capital | Reserves and Surplus | Insurance Fund | Disaster Fund |

|---|---|---|---|---|

| 2069/70 | 11.73 | 4.95 | 5.82 | - |

| 2070/71 | 11.73 | 6.64 | 8.11 | 0.41 |

| 2071/72 | 28.75 | 12.17 | 14.67 | 1.07 |

| 2072/73 | 37.37 | 11.4 | 23.9 | 1.99 |

| 2073/74 | 44.85 | 12.09 | 32.98 | 2.9 |

| 2074/75 (Proj.) | 58.17 | 23.15 | 45.27 | 4.26 |

| 2075/76 (Proj.) | 104.71 | 38.54 | 62.36 | 6.16 |

| 2076/77 (Proj.) | 115.81 | 61.52 | 87.9 | 9 |

The shareholders equity have grown from Rs 22.5 crores to Rs 92.82 crores in last 4 years. This shows a growth (CAGR) of 42.47%. The Company is expecting to grow at the same rate in the coming years. Thus, the shareholders equity is projected to reach Rs 274.23 crores by 2076/77.

The company needs to increase its paid-up capital by around 90% after the FPO. The company’s capital will hike to Rs 1 arba then. Even after meeting the capital requirement of Rs 1 arba as directed to Non-life insurance companies, Premier Insurance companies is planning to grow at its own pace. The company has projected to increase its Paid-up capital by 10 % in the year 2076/77.

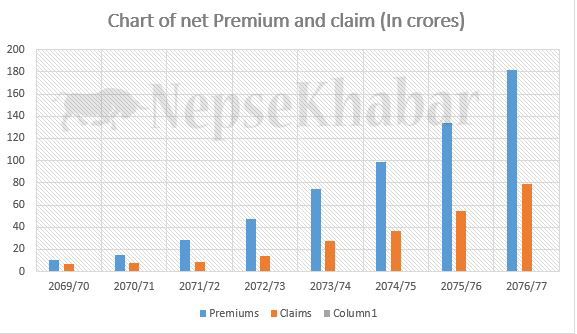

Premiums and claims

Premium collection and claim payment is the primary work of Insurance companies. Higher the collection of premium, higher will be the company’s profit. Looking at the growth in premium collection, one can easily conclude the company as a growing one. Where the premium collection was barely Rs 10.8 crores in 2069/70, the collection has massively surged to Rs 74.16 crores by the end of 2073/74. This shows a growth (CAGR) of 61.48% per annum .The company projects to increase the premium collection to Rs181.96 crores by 2076/77

On analyzing the claims paid by the company, the amount was just Rs 6.7 crores in 2069/70. However, on seeing the data of 2073/74, the net claim paid was Rs 27.76 crores. Higher the difference between premium and claim, higher will be the return for the shareholders.

Net Profit

As net profit is the amount left after deducting all the expenses from the available income, higher the residual amount (Net Profit) the better it is. The company’s net profit was Rs. 3.42 crores back then in 2069/70 that surged to Rs 18.15 crores by the end of f.y. 2073/74. This shows a growth (CAGR) of tremendous 51.63% per annum.

Dividend History

| Fiscal Year | Cash Dividend (%) | Stock Dividend (%) | Total Dividend(%) |

| 2068/69 | 0.79 | 15 | 15.79 |

| 2069/70 | - | - | - |

| 2070/71 | - | 14 | 14 |

| 2071/72 | 1.02 | 30 | 31.02 |

| 2072/73 | 1.05 | 20 | 21.05 |

The company has a decent dividend payout throughout the period. On analyzing the last 5 year dividend payout, company has regularly distributed profit among the shareholders expect in the year 2069/70. The dividend was as high as 30% in the year 2071/72. The shareholders can still expect a good dividend from the company, out of the regular income generation and the premium collected from the public offering. The company will still need to raise its capital by approx. 90% after the public issue, in order to meet the Insurance board’s directive for non-life insurance companies.

The company is currently traded at Rs 1380 in the stock market. The fpo price is Rs 799. Thus, this opportunity can be lucrative for short term investors. In the same way, looking at the progress of the company in term of premium collection, profit generation and other parameters this can be a good investment opportunity for long term investors too.