Is it worth investing your hard earned money in Butwal Power Company (BPCL) FPO ?

Company Overview

Incorporated as a private company limited initially, Butwal Power Company registered itself as public limited company on 6th falgun 2049. Shangri-La energy limited, Nepal Government, IKN Nepal A. S Norway, United Mission to Nepal, NEA and NIDC Development bank became the company’s major shareholders after Nepal Government sold its majority stake (75% of paid-up capital once and further 12% to public and employees) complying privatization Act, 2050.

Issue Details

|

Issue Units |

40,81,000 |

|

Price per Share (Rs.) |

501 |

|

Issue Opening Date |

15th Magh, 2074 |

|

Issue Closing Date (Early) |

19th Magh, 2074 |

|

Issue Closing Date (Late) |

15th Falgun, 2074 |

|

Issue Manager |

NMB Capital Ltd. |

|

Minimum Units |

10 units |

|

Maximum Units |

20,400 units |

|

ICRA Rating |

[ICRANP] IPO Grade 3 |

Capital Structure

|

Particulars |

Amount (Rs) |

|

Authorized Capital |

8 arba |

|

Issued Capital |

2.22 arba |

|

Paid-up Capital |

2.21 arba (after the public issue) |

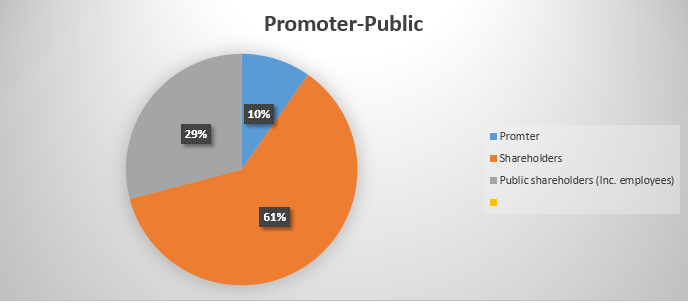

Promoter- Public Ratio

Key Shareholders

|

Particulars |

Shareholdings |

|

Nepal Government |

16,45,899 |

|

Shangri-La energy, Naxal |

1,2484,065 |

|

IKN Nepal A.S , Norway |

3,50,411 |

|

United Mission to Nepal |

3,03,233 |

|

Nepal Electricity Authority |

1,91,225 |

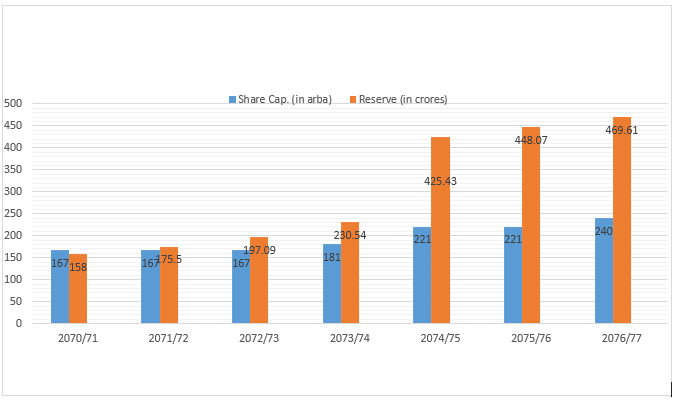

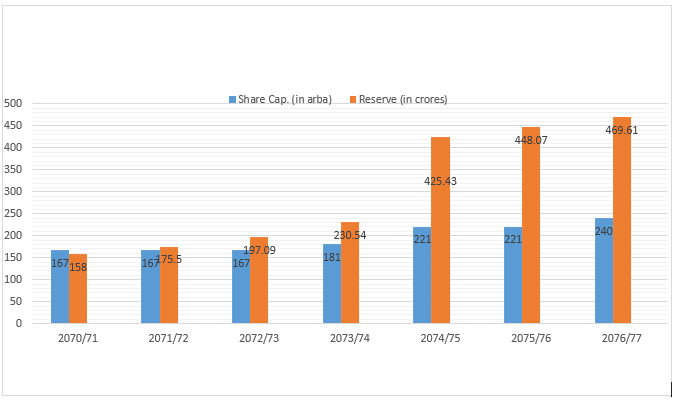

Share Capital

After the FPO, the share capital of the company will reach Rs 2.21 arba. On analyzing the projections, the company has planned to increase its capital by 10% next year. The company has accumulated jaw-dropping amount of reserve in the recent years. BPCL had 1.58 arba of reserve by 2070/71, however this has risen to 4.25 arba by last FY.

Table showing major ratios of the Company

|

Fiscal Year |

2071/72 |

2072/73 |

2073/74 |

2074/75* |

2075/76* |

2076/77* |

|

Networth (In Rs.) |

204.91 |

217.80 |

227.33 |

291.75 |

301.95 |

292.43 |

|

EPS (In Rs.) |

28.68 |

34.42 |

35.86 |

31.24 |

31.01 |

27.71 |

Utilization of Premium

The amount collected from the FPO will be used to invest in Ngadi Hydropower project and Kabeli A hydropower project. Any fund remaining after the mentioned investment will be used in Aadhikhola project and paying off loans for company’s new building.

Tentative Module

The ease provided by ASBA and especially C-ASBA can attract investors. Apart from this, the new rule regarding 10 kitta for every applicant may also contribute for the increase in the number of applicants applying for the FPO. However, low capital gain for short term shareholders will probably demotivate a lot of new applicants. Based on the past modules, data and applicants psychology, we can expect around 1.5 lakh applications for the FPO of Butwal Power Company.

With an assumption of 1.5 lakh applicants, we can expect the applicants to get 20 units each, with some even getting 30 units. The FPO size of 20 lakh units would have been enough to allot each applicants with 10 units. But the size being double increases the chances for applicants to get allotted with 20 units.

This issue can be lucrative for long term shareholders, but applicants looking for short term capital gain might not be attracted towards it. Thus, applicants willing to apply are recommended to apply for 20-30 units.

Recommendation

This issue can be lucrative for long term shareholders, but might not be the same for applicants looking for short term capital gain. Thus, applicants willing to apply are recommended to apply for 20-30 units.

Applicants can go to their respective banks having ASBA membership and apply for the shares using ASBA.