Is it worth investing in Radhi Hydropower ? In-depth Analysis of Radhi Hydropower IPO

The company had previously issued 4, 10,000 units to the local people affected by the project. However, approx. 36.47% i.e. 1, 49,550 units were not subscribed. The unsubscribed units along with the units allocated for the general public will be available for the general public. Thus, a total of 7, 64,550 units will be available for the general public.

Issue Details

| Issue Size | 7,64,550 |

| Price per Share (Rs.) | 100 |

| Issue Opening Date | 3rd Poush, 2074 |

| Issue Closing Date (Early) | 6th Poush, 2074 |

| Issue Closing Date (Late) | 17th Poush, 2074 |

| Issue Manager | Nabil Investment Banking Ltd |

| Issue to General Public | 7,11,031 units |

| Issue to Mutual Funds | 38,228 units |

| Issue to staffs | 15,291 units |

| Minimum Units | 50 units |

| Maximum Units | 3,800 units |

| ICRA Rating | [ICRANP] IPO 3 |

Company’s Overview

Radhi Bidyut was registered in company registrar as a public limited company on 5th Jestha, 2062. The registered office is situated in Tripureshwor-11, Kathmandu.

The hydropower is located in V.D.C Marshyangdi-5.

The water of radhi khola was utilized to build 4.4 mw Radhi Sana jalbidyut that started the commercial production in jestha 31st 2071 and added to national grid. The annual energy produced by the project is 26.26 GWh. The per megawatt cost for the project was Rs 13.9 crore. The PPA rate in the dry season is Rs 8.40 (Poush, Magh, Falgun and Chaitra) whereas it is Rs. 4.80 in the rainy season. The PPA rate will surge by 3% each year for 5 times after the commencement of commercial operation.

Capital Structure

| Particulars | Amount (Rs) |

|---|---|

| Authorized Capital | 1.50 arba |

| Issued Capital | 41 crores |

| Paid-up Capital | 41 crores (after the public issue) |

Promoter Details

| Particulars | Shareholdings |

| Lamjung Bidyut Bikas Company Limited | 1,952,513 |

| Syange Bidyut Company Limited | 139,474 |

| Ajtech Power Pvt. Ltd. | 268,249 |

| CEDB Hydro Fund | 106,704 |

Share Capital

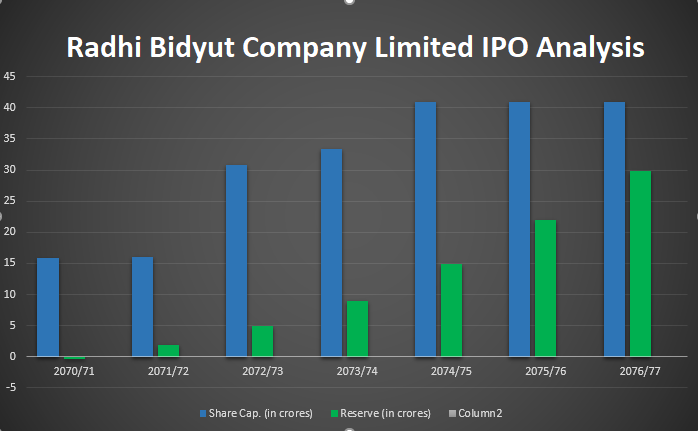

After the IPO, the share capital of the company will reach Rs 41 crores. On analyzing the projections, the company seems to have no further plans of capital increment in the next couple of years. However, in terms of the reserve the company is expected to accumulate approx. thrice the reserve in 2073/74.

Table showing major ratios of the Company

| Fiscal Year | 2071/72 | 2072/73 | 2073/74 | 2074/75 | 2075/76 | 2076/77 |

|---|---|---|---|---|---|---|

| Networth (In Rs.) | 111.79 | 115.44 | 126.42 | 136.14 | 153.38 | 172.79 |

| EPS (In Rs.) | 11.78 | 15.45 | 17.25 | 14.53 | 17.24 | 19.20 |

Key Indicators for the year 2073/74

| Particulars | Amount (In Rs.) |

|---|---|

| Share Capital | 33.35 crores |

| Reserve and Surplus | 8.94 crores |

| Net Profit | 5.75 crores |

| Networth Per Share | 126.42 |

| Earnings Per Share (EPS) | 17.26 |

Tentative Module

The ease provided by ASBA and especially online ASBA can attract a lot of investors. Apart from this, the new rule regarding 10 kitta for every applicant may also contribute in the increase in the number of applicants applying for the IPO. Based on the past modules and applicants data, we can expect 2.5 lakh applications for the IPO of Radhi Bidyut.

With an assumption of 2.5 lakh applicants, we can expect the allotment to go under lottery. An IPO needs to be approx. 25 lakhs units in order to satisfy all the expected applicants. Since this IPO issue is approx. 7 lakhs, approximately 70,000 applicants can be expected to be allotted for the IPO with 10 units each. Thus, only 28% of the total applicants can be expected to be allotted for the IPO.

Suggestion

Although the allotment is expected to go under lottery, the shares being issued at a par value makes it a risk-free investment. Due to the 10 units allotment rule, the applicants are suggested to apply for minimum quantity i.e. 50 units.

Applicants can go to their respective banks having ASBA membership and apply for the shares using ASBA.