Rising Interest expense Slows down BFIs Net Profit Growth? See which Commercial Bank was least affected

Analyzing the 3rd quarter report, we came to know the industrial growth of listed commercial banks have slowed down to 12% this year. The same was above 20% in the previous years. The logic for this is simple, the growth rate of expenses has exceeded the growth rate of income and as a result the net profit growth has decreased its pace.

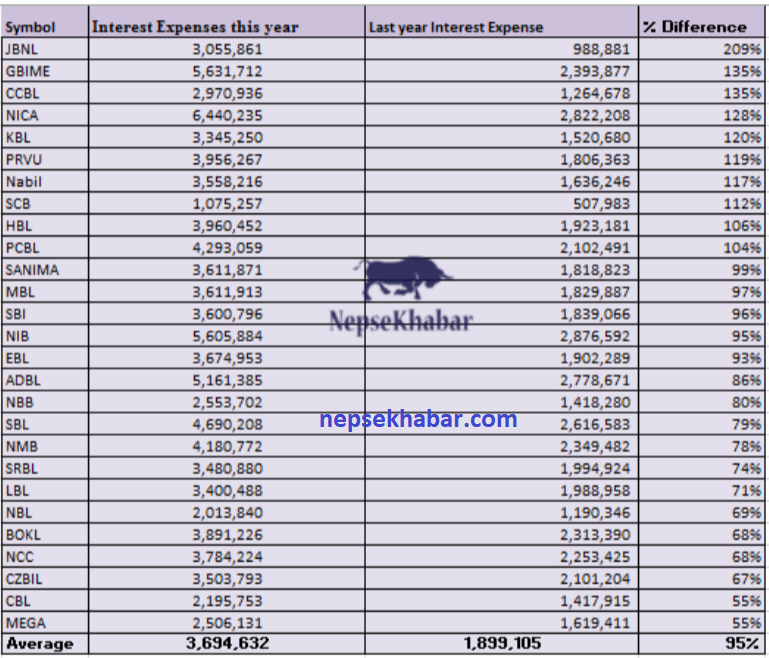

Reviewing the expense side of profit and loss in commercial bank’s balance sheet, one can easily notice the tremendous growth of interest expense. The unhealthy competition between BFIs to attract the deposits has resulted in an enormous increase of interest expense. The average interest expense growth of commercial bank stood astounding 95% in last one year.

While the average interest growth was 95%, the same for Janata bank stood over 200%. Similarly, Global IME reported a rise in interest expense by whooping 135%. The same was reported by Century Commercial bank. However, young commercial banks like Mega and Civil reported a rise of 55% each. With the interest expense rising so aggressively, the net profit growth was sure to experience a plunge.

The aggressive lending done by the BFIs, in order to increase their profit at the pace of capital, resulted a scarce of investable fund among them. BFIs, though had enough liquidity with them, could not lend easily due to the risk of CCD ratio crossing the ceiling. Thus, rising interest was the option opted by them in order to increase the deposit collection and expend their capacity to extend loans.

Amidst the rising interest rates, were there any possibilities for BFIs that could mitigate their risk of decling profit???

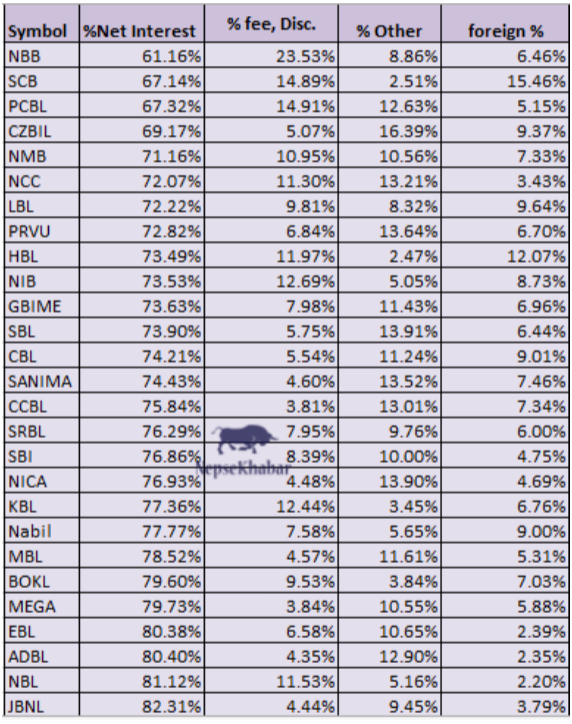

Well, yeah. Though Net Interest Income is the primary source of Income for BFIs, it is not the only means for revenue. BFIs earn from various other sources, such as: fee, commission, discount, foreign exchange and others. These all fall under the category of “Operational income”. At the time when Net Interest Income is slowing down, BFIs can emphasize on other revenue sources so as to maintain the net profit growth and increase the shareholders wealth. As the ultimate goal of any organization is to increase the shareholders wealth.

Seeing the data, we can conclude that Janata bank highly relied on Net Interest Income for its revenue, It was then followed by 2 state owned banks and then Everest Bank. In contrary, Banks like Nepal Bangladesh Bank and Standard Chartered had the least dependence upon Net Interest Income. Nepal Bangladesh Bank strengthened its Income from Fee and Commissions, whereas Standard Chartered earned around 15% of total operating income from foreign exchange and fee, commission each.

(Note : Mergers were seen as the main reason behind the rising interest for banks like jbnl, ccbl, kbl and the like)