See if the Commercial bank in your Portfolio is Performing better than Industry ?

As the 3rd quarter report for all the 28 commercial banks have published, it is now the time, for every rational investors, to compile and analyze the data so as to review their portfolio. Analyzing the report, and adjusting the portfolio is the key to get the best out of stock market. Comparing companies with the industrial average and comparing an individual company with its past performance, are the two best ways to analyze any company.

We, NepseKhabar team, have tried to compile the industry data of commercial banks and present it to our viewers so that a helping hand is provided.

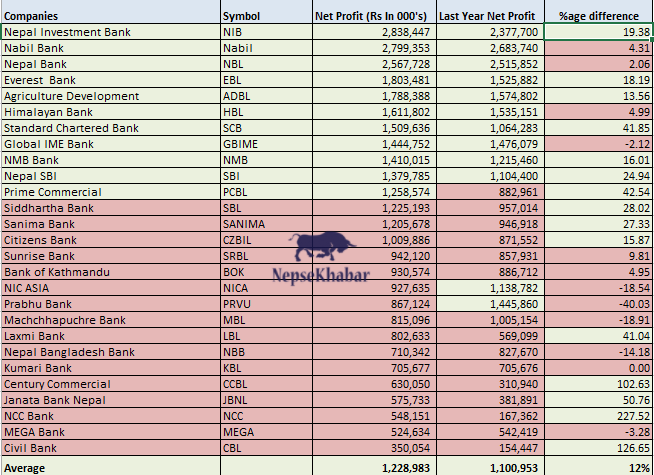

Net Profit

The ultimate profit earned by a company after deducting all the operational and non-operational expenses is the net profit. It is the amount that matters the most for an investor. Higher the net profit, higher the return. A certain portion of net profit is retained by the companies for the upcoming investment opportunities and operations, whereas some portion is distributed among the shareholders. The market price of a company also depends upon the profit earned, a poor earning company with less chances of growth is often traded at a low price in the stock exchange. Thus, Net profit is an important indicator to analyze at the time of investment.

The average net profit of Commercial banks have increased by 12% in one year. Where the average net profit of commercial banks was Rs 1.10 arba last year, it has increased to Rs 1.22 arba.

Nepal Investment Bank was and still remains the highest profit earning commercial bank. With Rs 2.38 arba this year, its profit has increased by 19.38% recording an above industrial growth. With just Rs 35 crores as net profit, civil bank is the lowest earning commercial bank. The company was, as still remains, at the bottom of the list. However, the growth shown by the company is mesmerizing. Thanks to the merger. NIC ASIA and Prabhu Bank, which had an above average earning last year, now don’t stay in the list anymore. However, Prime commercial bank has made it in the list this time, as it earns more than the industry. 11 out of 27 commercial banks have an above industry net profit this year.

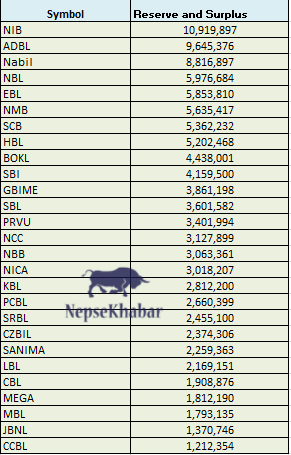

Reserve

Reserves are the portion set aside by the companies for the future. It arise as a result of past profitable operations. In simple terms, retained earnings are net profits that have not been distributed to shareholders as dividends.

In terms of reserves, NIB wears the crown with the highest reserve among the commercial banks. With hefty 10.91 arba in reserves, it is one of the fundamentally strong commercial bank. The list is then followed by Agriculture development bank, Nabil, Nepal bank. Young commercial banks, such as century, Janata bank, mega bank have low reserves. Machhapuchhre Bank, inspite of many years of operation and collection, stands along with Janata, Mega and Civil.

Deposit and lending

Deposit collection and loan extension are the primary business of banks. Higher the deposit, higher becomes the capacity for loan extension. And higher the loan extension, higher is the profit. On analyzing the deposit, an average of Rs 78.37 arba was collected by any commercial bank. With NIC Asia on the top of the list, collected Rs 1.33 kharba. NIB following NICA collected Rs 1.30 in the review period. 12 out of 17 commercial banks had a collection more than the industry.

In terms of loan extension, NIB leads the industry with disbursement of more than Rs 118 arba. An industrial average for loan extension stood at Rs 69.58 arba. 12 out of 27 were above industry again. Nepal Bangladesh Bank along with other young banks, such as Mega, Civil remained at the bottom.

Earning Per Share (EPS)

In terms of per share Earning, Nabil bank has the highest earning of Rs 46.41. Similarly, state owned commercial banks such as Nepal Bank and Agriculture development bank have an astounding EPS. Nepal Investment Bank, the highest net profit earning bank, have an EPS of Rs 35.55.

Late established commercial banks such as Century, Mega, Civil and Janata have the lowest EPS. Laxmi, Machachhapuchre and Nepal Bangladesh also have comparatively low per share earnings.