Siddhartha Investment Growth Scheme 1, A Real Success

Launched on 25th December 2012, Siddhartha Investment Growth Scheme has expired on 24th December 2017. This 5 year mutual fund having the fund size of Rs 50 crores was the first mutual fund to conceptualize and issue units as per “Mutual Fund Regulation, 2067”. The trading of this mutual fund has finally been suspended after Nepse publishing notice regarding the suspension. The fund will soon get liquidated and the unit holders will be refunded according to the assets value.

Investing the fund as per the mutual fund regulation, SIGS1 had successfully increased its net-worth and continuously provided its unit holders with handsome return. This mutual fund had the highest Net Assets Value compared to other Nepalese mutual fund in operation. Anyone buying SIGS1 units at par value of Rs 10 will get approx. Rs 21 per unit.

Had someone invested Rs 1 lakh at the time of IPO will end up getting approx. Rs 2.1 lakh soon. However the actual refund amount will be known upon the scheme’s liquidation. The benefits got by the unitholders can be calculated below.

Let us assume an Investor purchased 10,000 units of SIGS1 at the time of initial offering.

| Year | Net Assets Value | Dividend percentage (%) | Dividend received by Mr. A (Rs) |

|---|---|---|---|

| 2069/70 | 11.30 | 4.5 | 4,500 |

| 2070/71 | 21.09 | 15 | 15,000 |

| 2071/72 | 17.69 | 15 | 15,000 |

| 2072/73 | 32.75 | 30 | 30,000 |

| 2073/74 | 26.96 | 60 | 60,000 |

By the time of maturity Mr. A has received a total of Rs. 1,24,500 as cash dividend. The cash dividend provided by the scheme is more than Mr A’s initial investment. Assuming that Mr. A is refunded with Rs 2,10,000 (i.e. Rs 21 per unit) after liquidation of fund, his initial investment of Rs 100,000 will hike to Rs 3,34,500. Thus, investment in SIGS1 has increased his investment by a CAGR of 27.31% per annum.

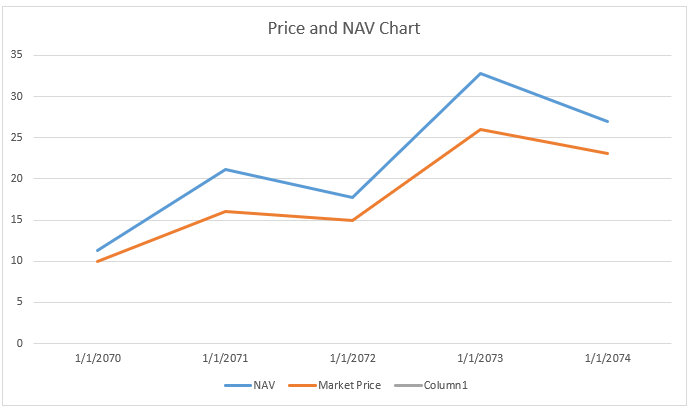

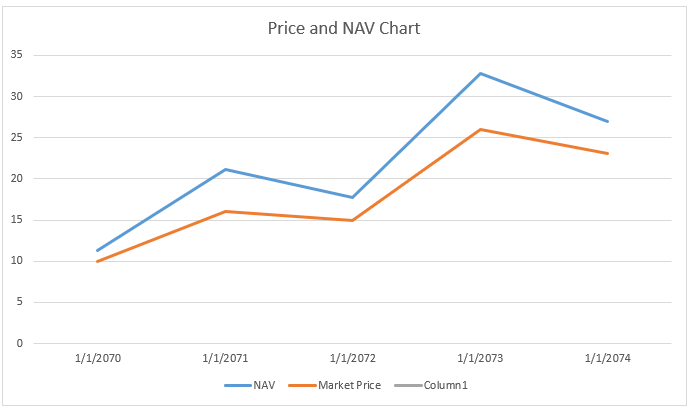

The Price and NAV chart of Siddhartha Investment Growth Scheme

On analyzing the journey of Siddhartha Investment Growth Scheme (SIGS1) one can easily get fascinated. Where other sectors provide 10-15% return in general, Siddhartha Investment Growth Scheme provided a return much more than the market. The high liquidity of the units and low market risk were the additional benefits available for the unit holders. Thus, we can conclude Siddhartha Investment Growth Scheme as a successful mutual fund.